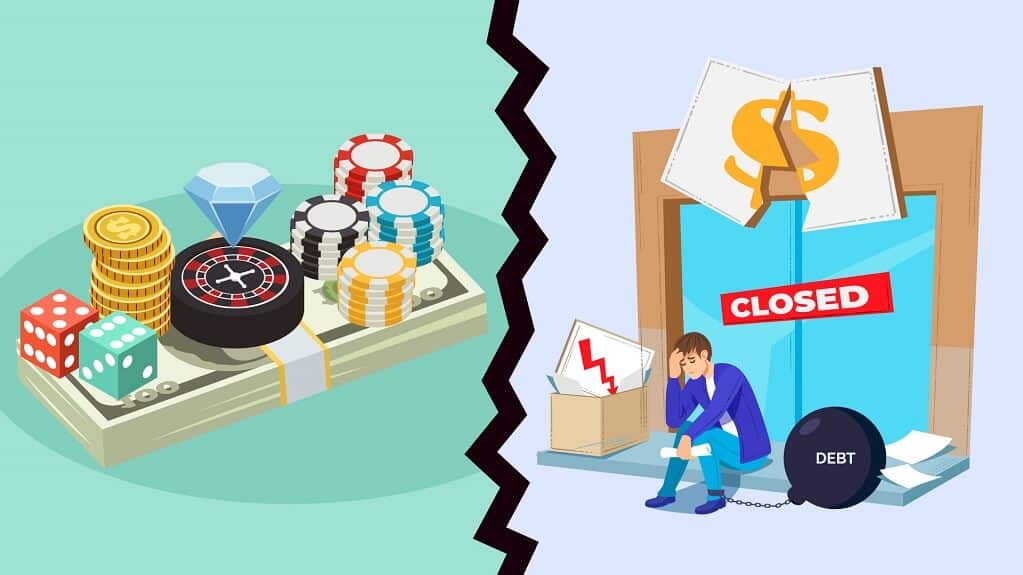

One of the traps gamblers may get into is the vicious cycle of getting cash advances in the hope that their future winnings will pay their ever-increasing debt. If left unchecked, it may lead to a downward spiral of accumulating debts. This situation may occur due to a player’s addiction to gambling. Gambling addiction is a compulsive disorder with emotional, financial, and social consequences. Addicts may continue applying for and getting loans and a cash advance to continue gambling and are unable to control their destructive behaviour. It can take several years to get out of gambling debt.

Gambling Bankruptcy?

Gambling debt includes debt that is incurred from the casino or loans charged from credit cards that can be discharged under bankruptcy. Moreover, gamblers can take the help of current bankruptcy laws, and they can file chapter 7 bankruptcy (for gambling debt forgiveness), which will help the gambler to discharge some of the major debts from gambling and give debt relief. Since gambling has been legalized in several countries, bankruptcy courts have become more liberal in allowing gamblers to discharge their gambling debts (if you have any gambling debt and need to get it solved, go with legal procedure).

Technically, gambling debt is dischargeable in bankruptcy, and there are no laws that prohibit the discharging of gambling debt. Specifically, the court might look at it differently from other types of debts. Besides, there is no statutory authority that states that debts are nondischargeable.

Fraud and Gambling Debts

Casinos issue casino markers so that their guests can gamble without needing large amounts of money. These casino markers are also called “Gambling markers”. Getting a loan is pretty straightforward: People can get loans through cash advances, credit cards, and other ways where they finally end up in credit card debt, bankruptcy, by just using their personal or credit card. If the individual is unable to repay the loans, it might lead to heavy gambling debts, and this might lead them to file for bankruptcy.

Are There Any Criminal Charges?

Even though there are several states like New York that criminalize gamblers to a certain extent, they also charge different penalties that are associated with crimes in gambling. Even though those sentences might involve penalties, gambling can be categorized as either a felony or misdemeanor and varies state to state.

Let us see some of the penalties for gambling –

Fines

In gambling, misdemeanor fines for gambling are very common, which start from a few hundred dollars to $2,000 and maybe even more. Moreover, Felony fines for gambling can be more significant, which might sometimes go up to 20,000 and more. Further, there can also be prison or jail sentences.

Jail/Prison

If a person is convicted for misdemeanor or illegal gambling, they would face a year in a local jail or a county. Few states impose small to maximum jail sentences like 20 days in jail; on the other hand, felony convictions can impose one year or more in prison, which might go up to 10 years.

Probation

Rather than adding jail sentences and fines, the courts can also impose probation sentences for the convicted gamblers. These probation periods last from 12 months to several years. If they do not adhere to the conditions, the court can revoke the probation and send the individual for serving the prison sentence.

How Do I Recover My Gambling Losses?

There are several ways an individual can recover their losses. People could go in for the chargeback feature, which is useful only if they did not receive anything for the payment. The individual also has the option of contacting fund recovery experts if they lost a huge amount of money in the casino.

How Much Do Gambling Addicts Lose?

- In earlier days, if the gambler did not have funds they would have to leave the table, but presently several casinos offer billions of dollars as loans to their customers every year in the form of credit, and they can also take loans from credit card companies too.

- As per a recent survey, a man’s average debt generated due to gambling addiction ranges from $55,000 to $90,000, while a woman’s debt is an average of $15,000.

- In some extreme cases, gambling can result in some problems like a financial ruin or serious legal problems (an individual needs to understand how the debt actually occurred). Besides, 20% of compulsive gamblers end up in loss and file for bankruptcy through attorney Serving The Atlantic City Area, New York or somewhere else (gambling debts must be able to discharge in bankruptcy).

- While filing for bankruptcy because of being unable to pay loans, it can affect gamblers in their personal lives. One of the recent surveys states that the divorce rate for the gamblers who have this problem is twice that of those who do not gamble.

- If the individual tries to get a loan from the casino or credit card company, they charge 3% to 10% interest or a bit more for their service. Moreover, the money wagered in casinos is half of the money which is physically brought by the gamblers, and the rest of the money is borrowed.

How Bad Is Filing for Bankruptcy?

- The gamblers who are not in a position to return the money they have taken usually end up filing for bankruptcy.

- While filing for official bankruptcy, certain forms need to be filled up, and some questions are asked about losses in gambling and several more. In some cases, the individual might be in debt from gambling, and in certain situations, the wife pays gambling debt if the husband commits suicide because of the debt.

- In simple words, an individual can get rid of the gambling debts in bankruptcy because these debts are considered unsecured, and they can be eliminated in chapter 7 bankruptcy (chapter 7 removes almost all cash advance credit cards debt). There are also a few situations that make these debts (other types of debt) a bit complicated in bankruptcy, but if the test determines the individual is eligible for chapter 7 bankruptcy, and there is no misrepresentation or fraud found, the individual can eliminate the gambling debts.

Final Thoughts

Gambling addiction needs to be addressed as early as possible, as it might lead to bankruptcies. There are several support groups and therapy sessions that help individuals to stop this addiction towards gambling, and they can lead a good life. There is a notion that if a gambler fails in one game, they try to pump in more money by getting loans in the belief that, when they win, they can return their debts even if there are odds against them. Hence utmost caution should be taken before taking loans for gambling.

All rights reserved by the Platform for features and functionalities.